For what good would their prosperity do them if it did not provide them with the opportunity for good works?

Aristotle

The financial industry is one of the few spaces that encourages greed. Companies, brokers, and stockholders are incentivized to bring in more. More money, more clients, and more products. Greed is an excessive desire for more than needed. Wanting your investments to be successful and profitable is permittable. When it becomes extreme, you are sliding into greed. Coveting more money from your portfolio can erode your gains and happiness over time.

Overconfidence Bias

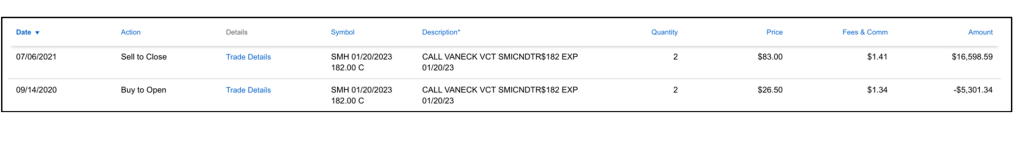

In 2020, I took a position in SMH, an ETF holding semiconductor stocks. My thesis was chips are the future of tech. With the Covid-19 pandemic the price had dropped, and I initiated a 2-year option (LEAP)position. Within 10 months, my position had increased by 200%. There were a lot of factors in my success. My thesis was correct. But more importantly, the tech market was feverishly bullish. It was my first gain in such a short amount of time. I now believed it was solely my ability to make a great trade. I had overconfidence bias. According to Investopedia, overconfidence bias is a cognitive error that leads individuals to overestimate their abilities and knowledge. This overconfidence turned me into a day trader. Over the next 3 months I turned $16,000 into $3,000.

Key Lessons

- Only invest long-term. Investors need to be aware of when they are being greedy. My first thesis took months to craft. The following failed trades were more like get rich quick schemes. For example, I saw a company bomb earnings and I was invested in it the same day. I was trying to catch falling knives. I knew it would go back up quickly. They didn’t and I blew up my account. Now, the minimum amount of time I spend in an investment is 1 year and 1 day.

- Have a plan for profits. How are your profits going to be used? Have a goal that is personal and will keep you from making poor decisions. I am aiming for a cushy retirement. My profits supplement my company retirement plan. You may have a plan to donate your profits to charity. Align your profits with your values.

- Set limits. I had to remove all notifications from my phone. I check the markets in the morning and after market close. Checking the markets constantly only leads to making rash decisions. Have a set list of stocks that you follow and only invest in those from your list. Have a timeframe of when you are going to sale. It could be retirement, 20, 10, or 2 years. Fill your time instead with people, places and things that bring you joy.

Beware of Greed

There is nothing wrong with growing your portfolio and wanting wealth. When that want becomes excessive, that’s when greed creeps in. Before investing any dollar, examine your motive and emotion behind your actions. Have you ever blown up your account? What did you learn from your experience?

Leave a comment